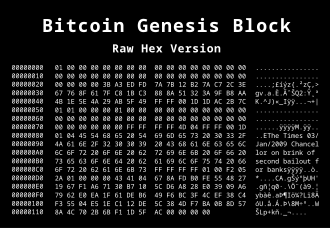

With the rise of digital currencies, many people are wondering about the potential profitability of investing in bitcoin. As we approach the year 2024, a lot of speculation surrounds the future of bitcoin and its value. One factor that affects the profitability of bitcoin is the Bitcoin Miners hashrate , which represents the processing power of the bitcoin network. In this blog post, we will explore the profitability of bitcoin in 2024 and shed light on why it could be a great investment opportunity.

Breaking the Barrier: Bitcoin’s All-Time High

In February 2021, we saw the price of bitcoin reaching an all-time high of over $58,000. This surge in value was driven by several factors, including the increased adoption of bitcoin by big companies like Tesla and Mastercard. However, what’s interesting to note is that the Bitcoin Miners hashrate also played a significant role in this increase in value. As more miners join the network, the hashrate increases, making the network more secure and efficient, ultimately driving up the value of bitcoin.

The Halving Effect

The halving effect, which occurs every four years, is another crucial factor that affects the profitability of bitcoin. During a halving event, the number of bitcoins produced every 10 minutes is cut in half, thus decreasing the supply. Since the supply is limited, the demand for bitcoin increases, leading to a rise in its value. The next halving event is expected to occur in 2024, which means that the supply of bitcoin will decrease even further, potentially driving up its value.

Mainstream Adoption of Bitcoin

As mentioned earlier, big companies like Tesla and Mastercard have started to embrace bitcoin, which has increased its credibility and adoption. This mainstream adoption is expected to continue in the coming years, as more companies realize the potential of utilizing bitcoin as a payment method. Moreover, with the recent announcement of Paypal introducing cryptocurrency transactions, we can expect even more widespread adoption of bitcoin by the end of 2024.

Stabilizing Market Volatility

One common concern surrounding bitcoin is its volatility, with values changing dramatically over a short period. However, as more companies start to adopt bitcoin, we can expect the market to stabilize. With larger players investing in bitcoin and supporting its growth, the market becomes less volatile and more attractive for investors. This, in turn, results in more stability and makes bitcoin a more profitable investment choice.

Furthermore, government regulations are also playing a significant role in reducing the volatility of the cryptocurrency market. As authorities around the world start to recognize and regulate bitcoin and other cryptocurrencies, it adds a sense of legitimacy and stability to the market. This makes bitcoin a more secure and attractive investment option, ultimately leading to its profitability in 2024.

The Power of Decentralization

One of the main advantages of bitcoin is its decentralized nature. Unlike traditional currencies, bitcoin is not controlled by any central authority, making it immune to government policies and regulations. This decentralization also means that no single entity can manipulate the value of bitcoin, allowing for a fairer and more reliable system. Moreover, as more people start to lose faith in traditional financial institutions, they might turn to bitcoin as a more secure and decentralized alternative, increasing its demand and potential profitability in 2024.

In conclusion, the future looks bright for bitcoin in 2024. With the Bitcoin Miners hashrate increasing, the halving effect, mainstream adoption, stabilizing volatility, and the power of decentralization, we can expect bitcoin to be a highly profitable investment. However, as with any investment, it’s essential to do thorough research and consult with professionals before making any decisions. As technology continues to advance and digital currencies become more prevalent, now might be the perfect time to consider adding bitcoin to your investment portfolio.